Many apartment investors don’t like debt, so rather than refinancing, they would prefer to pay off their loans. Why get a new loan when you’d prefer to have no loan? If that describes you, you may want to reconsider. Used wisely, debt is a powerful tool that can help you reach your short- and long-term investment goals. Let’s take a look at seven challenges and how refinancing can be a solution.

1. Your interest rate is more than 5%.

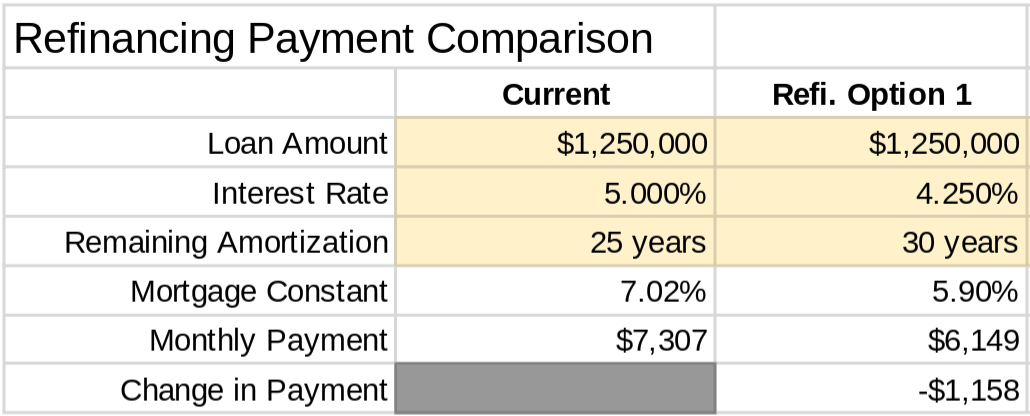

Many investors take a “set it and forget it” approach to their loans, especially if they are full term (i.e., amortize without a bullet due at maturity). At the time of this writing (May 2019), rates for straightforward apartment loans over $1 million are into the low-4% range. If you financed your property 8+ years ago, your rate could be lower by refinancing. Furthermore, if you reset your amortization schedule without increasing your loan amount, you can significantly decrease your monthly debt service and increase your monthly cash flow. You can see an example below where an investor with a $1,250,000 loan increases their monthly cash flow by $1,158. In this example, the investor last financed 5-years ago at 5%. By refinancing at 4.25% with no cash out and resetting their amortization to 30-years, the investor increases their cash flow by $1,158 each month.

What would this look like for you? Check out the simple refinancing comparison calculator on my website under Free Tools and you can quickly see how much a refinance would affect your monthly cash flow.

2. You want to pay off your loan even faster and get a lower rate.

On the other hand, some investors want to pay off their debt as soon as possible while benefiting from a new, lower rate. While the increased principal amortization will drive a higher total payment amount, you will save significantly on interest over the life of the loan. For investors interested in this approach, I can recommend lenders that offer fully-fixed, full-term 15-year and 20-year loans at competitive interest rates.

3. Your bullet loan is about to mature.

It’s time to consider refinancing if your loan is coming due in the next 12-months and there will be a balance due. While it may make sense for some investors to repay the loan at maturity, other investors may not have that much cash on hand or want to decrease their portfolio liquidity. For those investors, it is important to get ahead of your maturity to make sure you aren’t rushed and that you get the best terms and rate on your refinance. If you wait and run short on time, you may end up locked into a loan that costs you more in interest and has a punitive structure. Start by reviewing my Apartment Loan Handbook or my article “Financing Your Property in 7 Steps” to see if you can handle the refinancing yourself. If not, you may want to ask a loan broker to help you get the best loan.

4. Your property needs updating.

Tenants pay more rent for attractive properties. Compare your property to other available units in your market. Your property needs to look above average to get above average rents. If your appliances, cabinets, countertops, and floors are more than 20-years old, it’s time to refresh your property. Refinancing your property could provide the cash you need to cover these improvements and drive higher rents at your property.

5. You need to pay for seismic retrofitting.

Numerous cities in California are requiring investors to retrofit their properties to reduce the risk of structural failure during an earthquake. For example, Los Angeles requires retrofit of pre-1978 wood-frame soft-story buildings and non-ductile concrete buildings. The cost of retrofitting often exceeds $100,000. Most lenders are aware of these programs and encourage investors to draw on their equity to fund these retrofits.

6. You need to address deferred maintenance.

Have you been putting off roof or gutter repairs? By the time you hear of a leak, the damage may have already compounded, requiring more than just a simple fix. Free yourself of these risks by addressing deferred maintenance at your property as soon as possible. Many investors understandably delay significant maintenance work given the cost. However, these investors may not be considering the risk and opportunity cost associated with waiting. In the case of a roof, an unnoticed leak could cause structural decay and mold that cost thousands more to remediate in addition to the roof replacement cost. Accessing your equity with a new loan can help cover the cash needed to make these repairs without interrupting your cash flow.

7. You need cash for other investments.

Properties have massively appreciated since the 2008 downturn. If you haven’t refinanced since then, you’re likely sitting on similarly massive amounts of equity. You can access this equity tax-free by refinancing your property. You can use this equity to buy new investments or improve existing investments, all of which will improve your cash flow. As mentioned above, interest rates have returned to historic lows, so it’s a good time to lock your cost of capital.

Closing.

Many investors will still prefer to remain debt free. It simplifies their lives and ensures that the next 2008-esque recession won’t cause headaches. Nonetheless, even conservative investors can benefit from lower leverage loans (< 60% loan-to-value, > 1.40x debt service coverage ratio) to improve their properties, buy new investments, and increase portfolio cash flow. Provided investors use conservative, fully amortizing structures (e.g., 30-year term and amortization), they’ll having breathing room when the music stops in the next recession. Talk to your loan broker or advisor today about your options.