Should you write-off almost anything? Maybe not if you want to refinance your property and get access to your hard-earned equity. Consider that for every $1 reduction in reportable income, you could decrease your potential loan amount by $11-13.

You mean I should pay more in tax? It depends on your appetite for debt. If you want to use debt to lever and maximize your return on equity, then you should hesitate before minimizing your taxable income. While a lower taxable income means a smaller tax bill, it also reduces the apparent cash flow available to support a loan. And let’s not forget that an aggressive tax strategy could expose you to an IRS audit and tax court (even if the likelihood is low).

Consider the lender’s perspective. Let’s consider how your tax minimization strategy affects how a lender sees you and your property. In this discussion, I will call the write-offs associated with a tax minimization strategy “discretionary expenses.” Lenders will determine the maximum loan that your property can support based on the smaller of two loan sizing approaches: 1. maximum loan-to-value (LTV) and 2. minimum debt service coverage (DSCR).

Approach 1: maximum loan-to-value. Most conventional financing sources will lend up to 70-75% of your property’s appraised as-is value. The good news is that reducing your Net Operating Income with discretionary expenses will most likely not affect your appraised value. This is because the appraiser will value the property based on how the average market investor would look at your property. Most investors would recognize the nature of your discretionary expenses and remove them from the income capitalization analysis. Thus, discretionary deductions will likely not affect loan amount determined by the LTV approach.

Approach 2: minimum debt service coverage. Most lenders require a minimum debt coverage ratio between 1.20x and 1.25x. This means that your underwritable NOI must be at least 20-25% greater than the debt service associated with the proposed loan. Unlike the average investor, lenders will not add back discretionary deductions to your NOI. Instead, most lenders will look at the last three-years of operating statements (profit and loss statements) to evaluate whether the expenses are recurring. If you’ve been managing your tax liability for the last year, you might be able to convince the lender that your discretionary expenses are non-recurring, and the lender may credit your NOI accordingly. However, if you’ve been aggressively managing your tax liability for longer than a few years, your discretionary expenses will appear recurring, and the lender will most likely treat the expense as legitimate. Even if your operating statements aren’t consistent with your tax returns, some lenders rely on your tax returns instead of your operating statements. This makes it even harder to credit your underwritable NOI. Thus, discretionary expenses will probably affect the cash flow constraint and cause you to get a smaller loan.

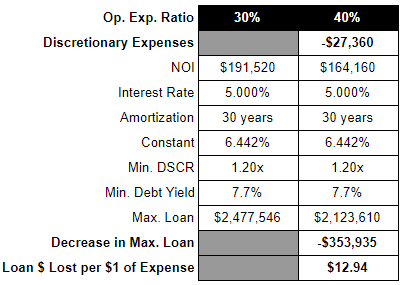

The table below shows how the math in approach 2 works with an example that assumes an additional 10% in discretionary operating expenses.

As mentioned above, you lose about $13 for every $1 of additional expense.

A bigger risk. In addition to getting a smaller loan than you deserve, the lender may consider your tax return fraudulent. The IRS awards whistleblowers up to 30% of the collected amounts from tax cheats. This is a strong incentive that may encourage a loan processor or credit analyst to report a potential borrower with aggressive tax minimization strategies. That being said, I have yet to meet a lender with a policy of reporting potential borrowers they believe to be tax cheats. Instead, lenders will generally decline the loan because of questionable character or offer the borrower a lower loan amount that their tax-managed NOI can support. Nonetheless, I would be hesitant to present a client’s request to a Federally regulated institution if that client’s financials suggested overt tax fraud.

So what’s an apartment owner to do? The IRS tells owners that business expenses must be “ordinary and necessary.” Creative property owners can stretch this flexible guidance to minimize their taxable income. But how far do you stretch this guidance? Most lenders will underwrite property cash flow assuming expenses are at least 30% of gross income with no upward limit. If you manage your expenses between 30-50% of gross rental income, you won’t raise any eyebrows at first glance and you will ensure the property can support the appropriate loan amount.

I will end with the necessary and trite disclaimer: consult with your tax advisor before implementing a tax minimization strategy but I hope reading this article helps you keep in mind the potential effect it will have on your ability to draw on your hard-earned equity.